Your home furniture will change lives.

Our mission is to end furniture poverty – one family at a time. As a social enterprise, revenues generated through our furniture removal service, fund our charitable activities.

Have unwanted furniture?

Extra furniture takes up valuable space. Selling it is a pain and you could call a junk removal service, but then it will just go into landfill, which is bad for the environment and a shame because someone who is living in furniture poverty could use it!

Experience a better way!

Furniture Bank provides a socially responsible furniture removal solution for the same price as the junkers but we use the money from your pickup to deliver furniture to families who need it. Free up your space. Help a family. Save the environment. Pay no tax AND get a tax receipt! It’s a win, win, win, win!

Hire our 5 Star furniture removal service.

Your best pricing for furniture removal in the Toronto area. Plus...

- Pay NO HST

- Receive a charitable tax receipt

- Avoid landfills and save the environment

- Competitive rates with bigger trucks - Get more in a single trip!

- Be a hero and help someone in need!

How it works

With Furniture Bank, your furniture can go from your home to a new home within 72 hours.

Request your pick-up and make payment over the phone

Get an estimate once you fill out our booking form. To keep the process contact-free, we handle payment upfront. 100% of the funds go directly to our charity operations and you will receive a tax receipt for the value of your furniture items.

We pick up your furniture

We provide email and text notices of our arrival times and you provide access to our team if needed. Our team is trained to follow proper distancing and safety protocols and will notify you when we’re done and departing.

Your furniture goes to a family in need

You make a huge difference for people in need. Basic needs including furniture, housewares, and other necessities of life help families move past simply ‘sheltering’ and towards building a successful home.

Featured on

Hire us to remove your furniture.

Your best pricing for furniture removal in toronto.

Make a tangible impact.

A house without furniture isn’t a home.

Basic needs

“They are literally choosing between buying food or a kitchen table to eat it at.”

13%

of Canada have unmet housing needs and chronic homelessness.

500,000

Over half a million Canadians households are living in social or affordable housing with a waitlist of nearly 300,000.

Dignity & pride

“There’s an unmistakable benefit for children who can interact with their friends in their own home without being embarrassed by their living situation.”

Dreams & potential

“The next Prime Minister of Canada could walk through our door, but they need a desk to do their homework at to reach that potential.”

5,000,000

5 million people living in poverty or approximately 2 million families.

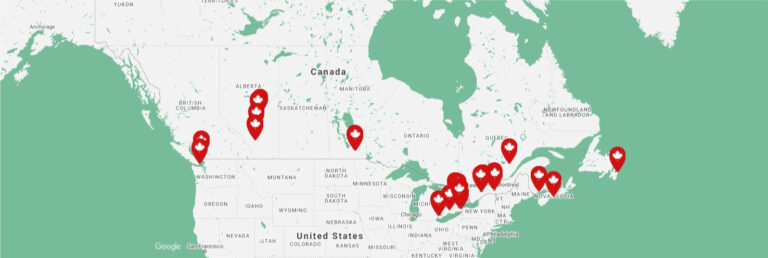

Canada’s most comprehensive furniture bank directory

Not from the GTA? Find a furniture bank near you to help give Canadian families the dignity of a furnished home.

Make a financial donation today and give the dignity of a furnished home to someone in your community.

Your gifts fund our essential service work for the community during these turbulent times.

Are you looking for furniture?

New clients (those looking to access furniture) must be referred to us through a community partner. Our partner agencies play a critical role by helping to screen potential furniture recipients.

Reviews from the web

- 5 out of 5 starsJana M3/10/2023Great Job Furniture Bank Team!!

The Team of Guys arrived early on during our Pick Up window. They were friendly, courteous and hard working. We had a lot of furniture to be picked up; they were out within an hour and a half.

They came prepared with everything that was needed. And to top it off, I feel good that someone else will be able to enjoy our well loved furniture.

Thank you so much; what a great service you provide!!5 out of 5 starsYasir Amr3/09/2023Extremely efficient and friendly service. I had my old couch in under a week. Both the staff answering emails/phone calls and those doing the actual moving were friendly to talk to and made the process easy and smooth. Also happy to know that our gently loved furniture is going to others who could still use and need it. Would use again in the future.5 out of 5 starsFrances Lew2/11/2023Simply an awesome team to work with. Exceptional communication, flawless pickup and so happy that we were able to help others. Folks will have some things within 72 hours of leaving our home to help them make a new home for themselves. The Furniture Bank should be commended for the selfless work they do. Great job! - 5 out of 5 starsSusan Courtney9/30/2022I was struggling to find what to do with most of the furniture in my home that I could not take in my upcoming move. It is great furniture and deserved a home. Fortunately discovered Furniture Bank. Very organized process. Prompt, professional and friendly pick up from inside my home. So happy to have found them. And delighted that our furniture will be re-homed so effectively and quickly. Truly an amazing organization.5 out of 5 starsPam Regan9/14/2022They are professional, efficient and you don't have to wait too long to say goodbye to your furniture. I truly like the fact they give your items to a needy family they don't sell them. For a small fee they pickup but you will receive a tax receipt for tax purposes to be used at yearend. Highly recommend!5 out of 5 starsSandee Sharpe8/13/2022Highly recommend the Furniture Bank. The two gentlemen who showed up were fantastic on communicating ahead of time. They were kind, considerate, helpful and beyond amazing. They really knew what they were doing and they were super quick! Thanks for such great service and for all that you do!

- 5 out of 5 starsEvan Friedman7/13/2022This was the easiest and best facilitated process. Just fill out a form describing what you have and where you are. Email/ phone interactions to qualify the items and a very simple appointment process....and away your furniture goes on a journey to be used again for those in need. Goodbye to our used furniture and hello to more space. Another step forward in our moving process! Thanks Furniture Bank!5 out of 5 starsZoë Saunders7/11/2022The team at furniture bank were incredible to deal with for this donation! They were communicative (both before and on the day of pick up) and the removal team could not have been nicer and more accommodating (finding parking in the middle of a construction site and getting everything moved carefully and quickly!) Beyond grateful that these pieces won’t end up landfill and instead get to help someone else turn their house into a home! If you’re considering donating through this team, please do so!5 out of 5 starsFrances Gilgunn7/11/2022Fast, efficient, friendly service! Furniture Bank never disappoints. This is the second time I’ve donated and I’m always impressed with the expediency and efficiency of getting the quote, booking the pick up and finally having the move and receiving the follow up receipt. The staff are friendly and helpful and my furniture pick up took all of 35 minutes. Thank you, and I’m glad my furniture is going to a good cause.

- 5 out of 5 starsMichael Lamport6/24/2022They are devoted to helping people in need and I was sooo happy to donate my antique Queen Anne dining table and six chairs...the dining set has been around for over 200 years and has many stories locked inside and the new owner can add to them I'm sure. The guys who came to pick the furniture up were very polite and very quick! I have more items that I intend to donate in the coming months. This is like FB (Furniture Bank) on FB (FaceBook)!!!! lol.5 out of 5 starsMaureen Chomica5/26/2022From first contacting the Furniture Bank by email to arranging for pickup of our couches and living room furniture the process was so EASY. Very professional on the phone, and this continued to the two gentlemen who picked up every thing, I can’t compliment them enough. What a great organization!5 out of 5 starsCass McD5/15/2022I contacted the Furniture Bank about a pick up of items I wanted to donate. They were incredibly quick in getting back to me and friendly and helpful when I contacted them to book the pickup and in responding to my follow up questions.

The movers showed up as scheduled- calling ahead of time, they were friendly and professional and fast! It was a great experience and it felt so good knowing I was making a small difference in someone’s life.

Ready for your pickup?

Your best pricing for furniture removal in the Toronto area. Plus...

- Pay NO HST

- Receive a charitable tax receipt

- Avoid landfills and save the environment

- Competitive rates with bigger trucks - Get more in a single trip!

- Be a hero and help someone in need!