Furniture Donations – Household

When we think of protecting the environment, most of us make small changes such as using reusable bags, reducing water consumption, or turning off lights when we leave a room. However, one area that is...

What is excess inventory? Excess inventory refers to a surplus of goods or products that surpasses the current demand or anticipated sales, leading to an imbalance in supply and demand. Navigating the challenges of surplus...

Are you downsizing or clearing out a few pieces, maybe needing to get rid of furniture that doesn’t work for your space or no longer brings joy to your home? Why not donate them? While it...

Do you have furniture taking up space in your home that could be put to better use? Are you looking for an easy way to donate it rather than simply throwing it away? You’re in...

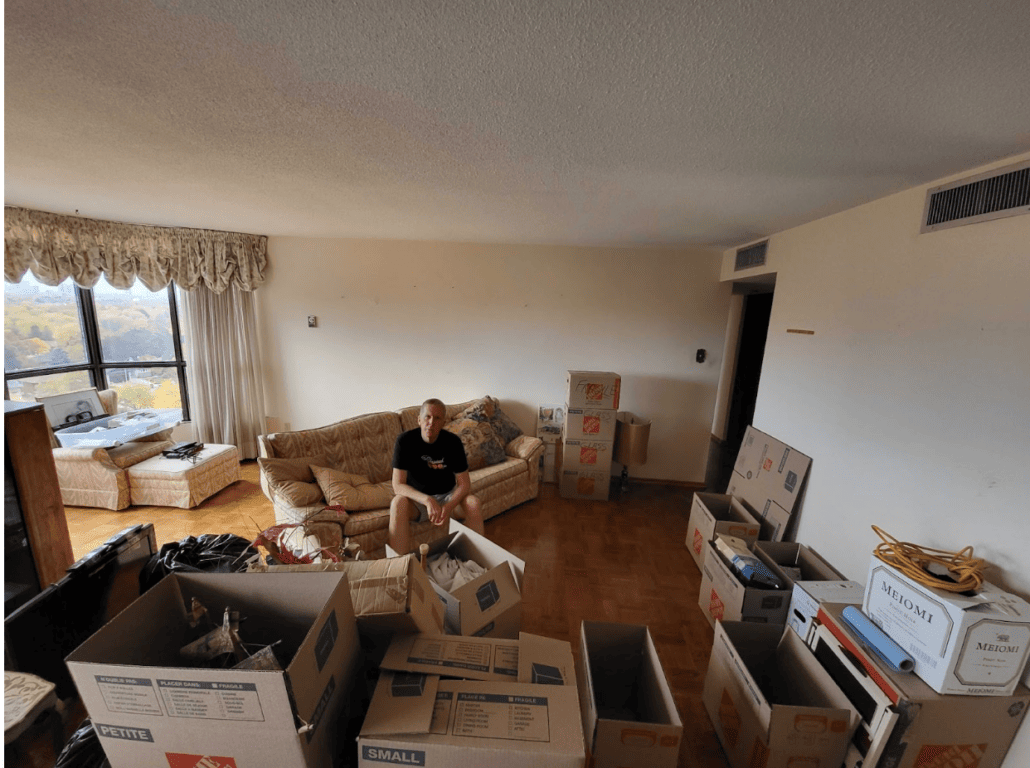

Are you looking to downsize your living space or declutter your home? Maybe you’re moving and don’t want to move bulky furniture. If so, consider donating them! Donating furniture can be a great way to...

Clearing out a family home can be challenging. It’s a time to reflect on all the memories made in the house, and it can be difficult, emotional and overwhelming to decide what to do with...