By Heather Simpson & Dan Kershaw

There was some news in the world of social impact yesterday as the Social Finance Fund came one step closer to reality with the announcement of the wholesalers – Boann (a joint venture of Encasa Financial and the Table of Impact Investment Practitioners Trust), Realize Capital (an alliance that includes Rally Assets and Relay Ventures and Cap Finance (led by Réseau d’investissement social du Québec and Fiducie du Chantier de l’économie sociale). There are still a few steps before the Social Finance Fund will start to provide financing to social purpose organizations (SPOs) in Canada, but this is an important, and long-awaited, step forward.

The Social Finance Fund offers the potential to create new sources of capital for charities, nonprofits and for profit social enterprises. If it lives up to its potential, the Social Finance Fund will catalyze positive change, by lowering the barriers to access that SPOs so often face in seeking to access the capital they need to scale their impact.

Among the organizations poised to benefit from the Social Finance Fund is Furniture Bank, a charity and social enterprise that has been making a tangible difference in communities by providing essential furniture to families in need, while simultaneously diverting usable furniture from landfills. However, the journey to create impact is not without its challenges, and Furniture Bank, like many in the non-profit sector, has faced and continues to face financial hurdles as it looks to expand its operations and acquire critical assets.

Heather Simpson, a nonprofit consultant with a background in social finance, and Dan Kershaw, Executive Director at Furniture Bank offer their thoughts on the potential role the Social Finance Fund can play in the future of Furniture Bank, highlighting the broader implications for the non-profit sector. Heather and Dan have a shared understanding of the potential of social finance, dating from a shared experience in 2014 when Dan came to Alterna Savings Credit Union where Heather was working at the time because Furniture Bank needed a loan, and he knew they weren’t well positioned to be asking for one.

What is the Social Finance Fund ?

The Social Finance Fund is an innovative Government of Canada initiative aimed at stimulating social finance investment and strengthening the capacity of SPOs in Canada. The $755 million fund, which was originally announced in the 2018 Fall Economic Statement, aims to encourage innovative approaches to persistent social and environmental challenges, while promoting sustainable economic growth and social inclusion.

The fund will provide:

- Financial support through accessible financing, such as loans, guarantees, and equity investments, to eligible SPOs. This support helps SPOs scale up their impact-driven projects and initiatives.

- Capacity building through grants and resources to help SPOs develop their skills, business models, and financial management capabilities, making them more investment-ready and sustainable.

- Investment mobilization through the attraction of private capital with the goal of creating a robust social finance market in Canada,and facilitating collaboration between private investors, public institutions, and SPOs.

The Social Finance Fund is designed to empower charities and nonprofits by providing them with financial support, capacity building, and investment mobilization. The program aims to enhance the social and environmental impact of these organizations while fostering innovation and resilience in the sector. The fund will do this by helping to ensure that organizations have better access to capital, and are therefore better able to respond to community needs.

While capacity building grants are a component of the Social Finance Fund (and many organizations have benefitted from the $50 million Investment Readiness Program over the past few years), the primary purpose of the fund is to increase the availability of repayable capital. This is an important fact to remember as many nonprofit and charity run programs do not have the associated revenue generating programs or activities needed to support a loan. As such, the Social Finance Fund will not replace the need for philanthropic capital, but it may help reduce the demand for grant financing, and for those organizations, like Furniture Bank that are operating social enterprises, it creates a new potential source of capital, that ideally will be more flexible, and nimble, allowing SPOs to access financing when they need it, rather than having to wait for the right granting program to come along.

The potential of the Social Finance Fund for Furniture Bank

For a charitable organization like Furniture Bank, the Social Finance Fund offers the potential to access loan capital. While many in the charitable sector are understandably hesitant to take on a loan, it can be a really sound financial decision. One of the first lessons that is taught around personal financial literacy is that there is good debt (debt that helps you to acquire an asset, or to generate income) and bad debt (debt that doesn’t do those things), and the same holds true for a charity looking to take on a loan. A mortgage to acquire a building that will have residual and likely increasing value is an example of good debt. A loan to acquire a truck or piece of equipment that will allow for the generation of revenues is also an example of good debt, provided there is a viable plan for repayment. It can also be a good management decision to take on a line of credit or bridge financing to navigate cash flow fluctuations. By contrast taking on a loan to cover a funding shortfall should likely be considered bad debt.

Furniture Bank has two potential financing needs:

- Furniture Bank would like to eventually be able to acquire a warehouse space that is owned – this would allow the organization to save money on rent and start to build an asset that could be leveraged in the future, a mortgage will be required to make this a reality.

- As Furniture Bank grows, they need more trucks on the road to support their social enterprise, loan financing allows Furniture Bank to acquire a truck when it is needed, rather than having to wait on grant funding or pull revenues away from funding other programs.

Furniture Bank and its social enterprise appears to be a fit with the objectives of the Social Finance Fund. Furniture Bank provides social and environmental impact by providing essential household items to families in need, promoting social inclusion, and reducing waste by diverting furniture from landfills. The trucking social enterprise further contributes to social impact through job creation and the employment opportunities offered to those facing barriers to employment. Most importantly Furniture Bank generates revenue through its trucking social enterprise by charging fees for furniture pick-up services.

Furniture Bank has accessed loan financing in the past. In 2014, shortly after Dan first came on board at Furniture Bank, he approached Alterna Savings Credit Union (Alterna) for a loan to purchase a truck. Furniture Bank was in a difficult financial position at the time, and Dan knew that accessing financing would be a challenge. But he came prepared. First, Dan knew his business and financial model inside and out. He understood the financial circumstances that the organization was in (Furniture Bank had been operating at a considerable deficit), and had developed a well planned and realistic strategy for how to move the organization to a better financial position. He knew what he was talking about, and could tell a clear and compelling story, with numbers and timelines for how the organizational turnaround would occur. He could even clearly articulate why he was seeking a loan, rather than waiting for a grant — he wanted grant funding for other aspects of Furniture Banks work, and didn’t want to wait for the right granting opportunity to come around as there was a considerable opportunity cost (upwards of $10,000 in net income each month he did not have an additional truck on the road).

Second, Dan spoke the language of his lender. He understood that he was going to Alterna to ask for a loan, something he would be expected to pay back. He deviated from the “we won’t survive without your support” narrative that nonprofits are so accustomed to when seeking funding, to a message of “your support will make us stronger” through additional net revenues of $10,000 per month. This set the right tone. His presentation also answered the two most important questions that lenders are looking to answer when making a decision about a loan:

- Are they going to pay me back? In this case Dan could clearly demonstrate that there was sufficient demand through the social enterprise for furniture pick-ups that the net result from having an additional truck on the road was $10,000 additional cash in hand at the end of every month. This would more than cover the loan repayments.

- What do I get if they don’t pay me back? While it wasn’t the traditional type of collateral that Alterna worked with, the truck that Furniture Bank was looking to acquire was one that was in demand and which retained its value long term, even in secondary markets.

Ultimately, Alterna did provide Furniture Bank with the needed loan financing. Had Dan not been as prepared as he was for his conversations with the credit union, it is unlikely the loan would have been approved. While a lot rests on the Intermediaries selected, the Social Finance Fund should work to help ensure that loans like the one Alterna provided to Furniture Bank became more common and less dependent on a savvy Executive Director who understood how to speak the language of the lender.

A bigger potential of the Social Finance Fund for Furniture Bank

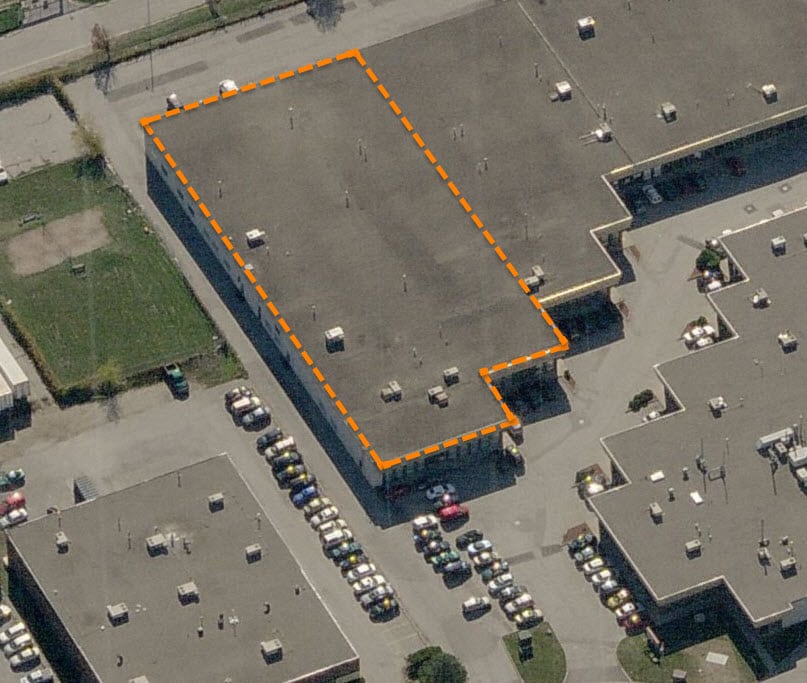

The Social Finance Fund could have an even greater impact on an organization like Furniture Bank around the provision of mortgage financing to acquire a warehouse. Furniture Bank needs approximately 50,000 square feet of warehouse space at Toronto market prices (approximately $16-18 million according to Q1 2023 data). Commercial lenders require borrowers to have 20-25% of the purchase price as a down payment (some will require up to 30% from a nonprofit). This means Furniture Bank will need a cash amounting to somewhere between $3.2 million and $5.4 million to acquire their desired warehouse. Most nonprofits, Furniture Bank included, find it very difficult and time consuming to raise this amount of capital.

It remains to be seen what types of structures the Social Finance Fund will contain to be able to support this type of loan. With the ability to redirect rent payments to the mortgage, and the ability to scale due to increased facility size, Furniture Bank is more than capable of servicing a mortgage of this size, but will the lenders be open to taking on additional risk due to a significantly lower down payment? Will there be some sort of loan guarantee or other de-risking tool that lenders can access through the Social Finance Fund in order to move a loan like this forward? While it is anticipated that the Social Finance Fund will make some provisions for social purpose real estate, the details have yet to be announced. It is these details that will make all the difference for an organization like Furniture Bank.

Social Finance and the Future of Furniture Bank

The Social Finance Fund has the potential to play an important role in helping to scale the impact of Furniture Bank and other similar organizations. While the path to implementation has been slow, and there are still details to be worked out, Furniture Bank is understandably excited by the potential of the Social Finance Fund and what it could mean for the organization’s desire to grow nationally. While an organization like Furniture Bank will always rely on grants and the generosity of individual donors to support its work, the strength of the social enterprise can be leveraged to support access to loan financing, keeping philanthropic dollars in areas where they are most needed, and leveraging repayable loan capital to acquire an asset or minimize opportunity costs. By helping to ensure that Furniture Bank can access the financial capital it needs when it needs it, the Social Finance Fund will play a vital role in deepening the impact that Furniture Bank can have on the community. With a strong social enterprise model, and a history of borrowing, It is safe to say that social finance is likely to continue to play an important role in the future of Furniture Bank.